About H2 Investment Managers

H2 Investment Managers is an equity research service focused on long term wealth creation. The H2 Investment Managers is headed by Hitesh Chauhan, a well known investor.

He has been associated with equity markets for more than 20 years in various capacities as equity portfolio adviser to various HNI’s and now a full time investor and investment advisor.

Watch the video to understand the strategy of H2 INVESTMENT MANAGERS and more...

About Us

About Me

Hitesh Chauhan is a Chartered Accountant and SEBI registered Research Analyst (INH000007030). He has been associated with equity markets for more than 18 years in various capacities as equity portfolio adviser to various HNI’s and now a full time investor and investment advisor. He has also taken lectures at ICAI on Equity Markets. This association has helped him inculcate so many learnings from Mr. Market riding through the ups and downs, and there is no short cuts to make wealth. The biggest learning has been that one has to be a keen learner in markets throughout one’s life.

What is our investment philosophy?

We prefer to invest sectors/stocks that are in uptrend. The underlying companies should have strong earnings growth, good return ratios and ethical management. The balance sheets of these companies should be strong with low debt and should generate regular free cash flow.

Good risk management practices also form a part of our portfolio. We take defined risk positions in each stock and overall risk of the portfolio is also capped. We use technical analysis and fundamental of a stock in order to time our entry and exit.

The objective of the Portfolio would be to endeavour to generate alpha & superior risk adjusted returns for investors over the long term.

Fundamentally sound businesses:

- Companies which have earnings growth behind them and are expected to grow in future

- Strong cash generation

- Return ratios above cost of capital

- Ethical management

- Prefer low free float stocks

- High promoter holding

- Low debt on books

- Good operational metrics

Stock price parameters

- Figure out which sectors/stocks are in uptrend. Invest only in them.

- High P/E Ratios are not a no go area for us.

- Institutions/Promoter should be increasing their stake in the stock

- Regular profit booking depending on proprietary rules

- We always book small losses before they turn into big losses.

We make exit in 3 situations

- Overvaluation: If the share price rises too quickly and becomes disconnected from the underlying business fundamentals, signaling that it’s overvalued.

- Underperformance: If the company’s growth doesn’t align with the initial expectations, and the potential for future success doesn’t seem promising anymore.

- Better Opportunities: When a more attractive investment presents itself, offering higher potential returns compared to the existing position.

19+

Years of experience

INH000007030

SEBI Registered

Complaint Status

- Current Month

- Monthly

- Annual

| Received From | Pending at the end of last month | Received | Resolved | Total Pending | Pending complaints > 3M | Avg. resolution time |

|---|---|---|---|---|---|---|

| Directly from Investors | 0 | 0 | 0 | 0 | 0 | 0 |

| SEBI (SCORES) | 0 | 0 | 0 | 0 | 0 | 0 |

| Other Sources | 0 | 0 | 0 | 0 | 0 | 0 |

| Grand Total | 0 | 0 | 0 | 0 | 0 | 0 |

| Month | Carried forward previous months | Received | Resolved | Pending |

|---|---|---|---|---|

| Dec – 24 | 0 | 0 | 0 | 0 |

| Jan – 25 | 0 | 0 | 0 | 0 |

| Feb – 25 | 0 | 0 | 0 | 0 |

| Mar – 25 | 0 | 0 | 0 | 0 |

| Apr – 25 | 0 | 0 | 0 | 0 |

| May – 25 | 0 | 0 | 0 | 0 |

| Jun – 24 | 0 | 0 | 0 | 0 |

| Jul – 25 | 0 | 0 | 0 | 0 |

| Aug – 25 | 0 | 0 | 0 | 0 |

| Sep – 25 | 0 | 0 | 0 | 0 |

| Oct – 25 | 0 | 0 | 0 | 0 |

| Nov – 25 | 0 | 0 | 0 | 0 |

| Grand Total | 0 | 0 | 0 | 0 |

| Year | Carried forward from previous year | Received | Resolved | Pending |

|---|---|---|---|---|

| 2020 – 2021 | 0 | 0 | 0 | 0 |

| 2021 – 2022 | 0 | 0 | 0 | 0 |

| 2022 – 2023 | 0 | 0 | 0 | 0 |

| 2023 – 2024 | 0 | 0 | 0 | 0 |

| 2024 – 2025 | 0 | 0 | 0 | 0 |

| Grand Total | 0 | 0 | 0 | 0 |

FAQs

Do not subscribe if:

- You are going to want the money for whatever reasons in the next 2-3 years. You SHOULD NOT be investing in equities if you do not have at least a 5 year investment perspective.

- You are seeing for short term calls or if you essential to generate a certain amount of return every month SHOULD NOT SUBSCRIBE

- You cannot handle price volatility. Equities by its very nature will be volatile. Prices will go up and down. You need to be able to accept the fluctuations without it creating stress in your life.

- If you have a long-term craving to generate wealth for yourself and your family.

- If you are having a passion like turtle (story of rabbit & turtle) and small amount of hard earned money, you will get multiple amount of money at the end of 5-10 years.

- If you see business channels on TV or read business dailies and invest in stocks based on free advice given there. Please remember, free advice is decent but most often than going to end up costly to you much more than subscribing to a good, honest and ethical advisory service.

- If you are a business owner, professional, salaried person with excess funds that you can deploy in equities. You invest saving money (lumpsum) to start or even to choose stocks in SIP mode can be beneficial.

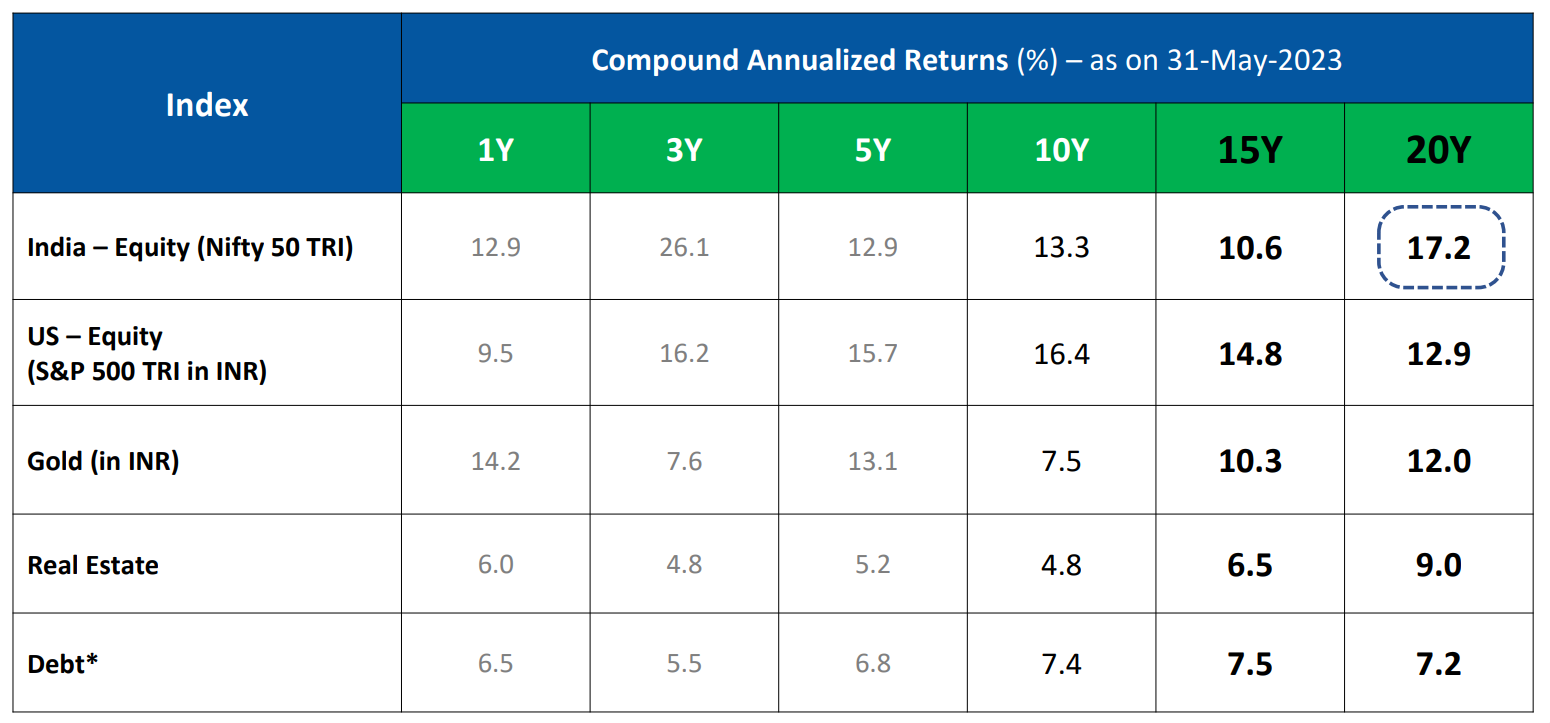

If you had invested Rs 1 lakh in Indian equities 20 years back, it could have grown to approx Rs 24 lakh by now. However, the value of the same investment in Gold and Real Estate could have been just around Rs 9.6 lakh and Rs 5.6 lakh respectively in 20 years. The value of Rs 1 lakh invested in the US equities could have been just around Rs 11.3 lakh in 20 years, a calculation based on a report on 20-year returns from these asset classes shows.

We do not have any fixed number of recommendations. We believe in building a strong portfolio of stocks. Directly on subscription, you will get access to the current list of recommended stocks.

In equities, nothing is certain. We effort to shape a portfolio of stocks that will perform well over a market cycle. We also have a calculated and momentum advisory to enable us to make alpha. But equity investment entails risk and as an investor you should be ready for important drawdowns once every few years.

We believe in buying quality and growth companies at a reasonable price that are undervalued with huge potential to grow in the future. We invest in companies having strong fundamentals, a strong balance sheet, low debt, cash-rich, resilient management and high promoter’s stake and avoid highly leveraged business.

Our investment strategy is focused on generating wealth over the long term. Hence we recommend investing INR 5 – 10 Lakh over 3-5 years to fully take advantage of the portfolio.

All sales are final. There will be absolutely no refunds and cancellations are subject to certain exceptions.

Disclosure of Status of Compliance Audit Report

In accordance with Regulation 25(3) of the SEBI (Research Analysts) Regulations, 2014, and SEBI circular SEBI/HO/MIRSD/MIRSD-PoD-1/P/CIR/2025/004 dated January 08, 2025, the status of the latest compliance audit report is provided below:

| Financial Year | Audit Status (Compiled/Not Compiled) |

|---|---|

| 2022-23 | Compiled |

| 2023-24 | Compiled |

| 2024-25 | Compiled |